The Role of Tech in Financial Markets: Fintech Revolution

Financial markets have undergone significant transformations over the years. From traditional open outcry trading pits to sophisticated electronic trading platforms, the landscape of finance has evolved rapidly. These changes have been driven by advancements in technology, globalization, and regulatory reforms, shaping the way investments are made and assets are traded.

With the widespread adoption of digital platforms and the internet, investors now have access to a wealth of information and tools at their fingertips. This has led to increased transparency and efficiency in the financial markets, enabling a broader participation of retail investors and facilitating faster execution of trades. Additionally, the rise of online trading has lowered the barriers to entry, allowing individuals to easily buy and sell financial instruments from anywhere in the world.

The Impact of Technology on Trading Practices

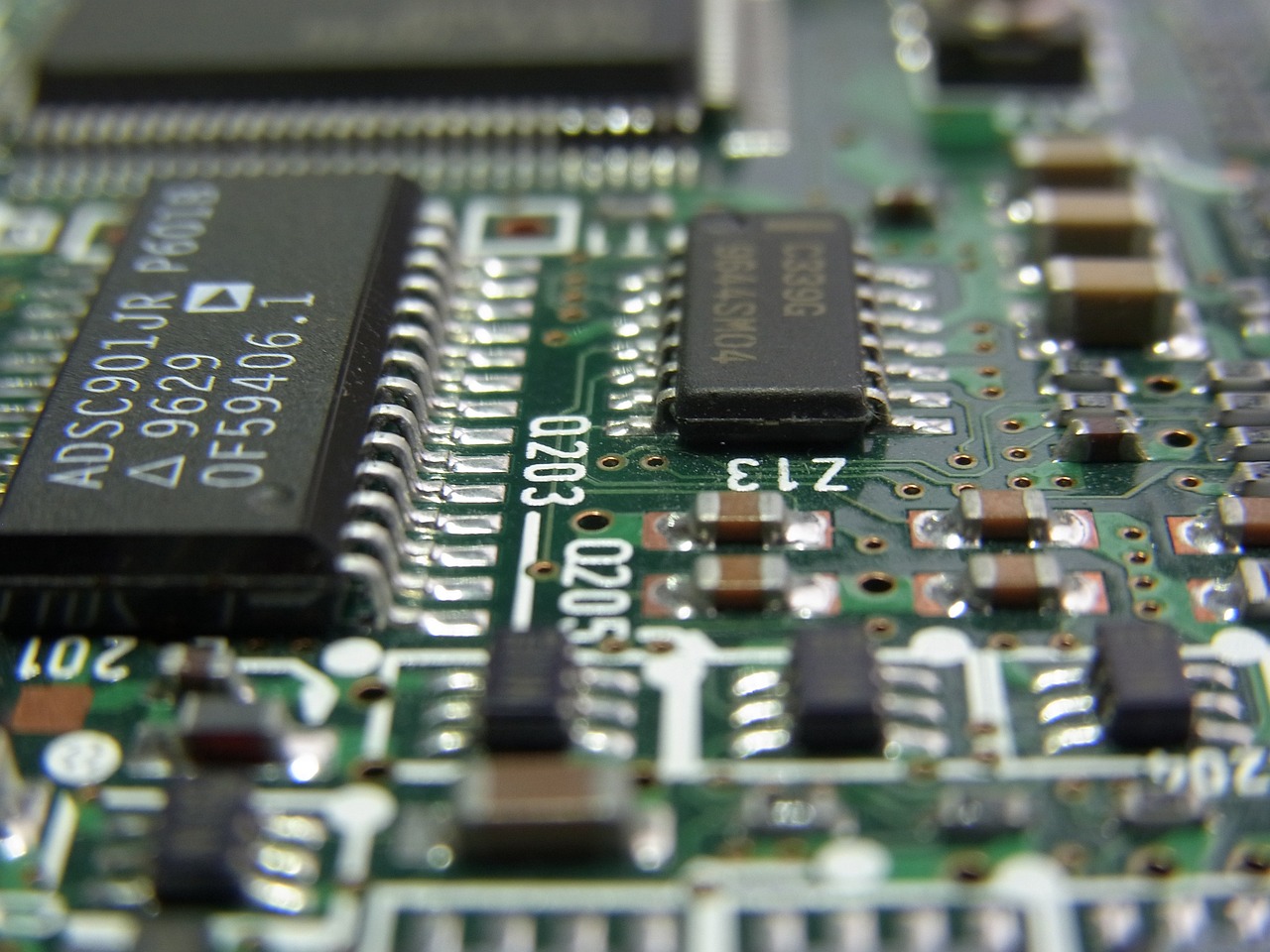

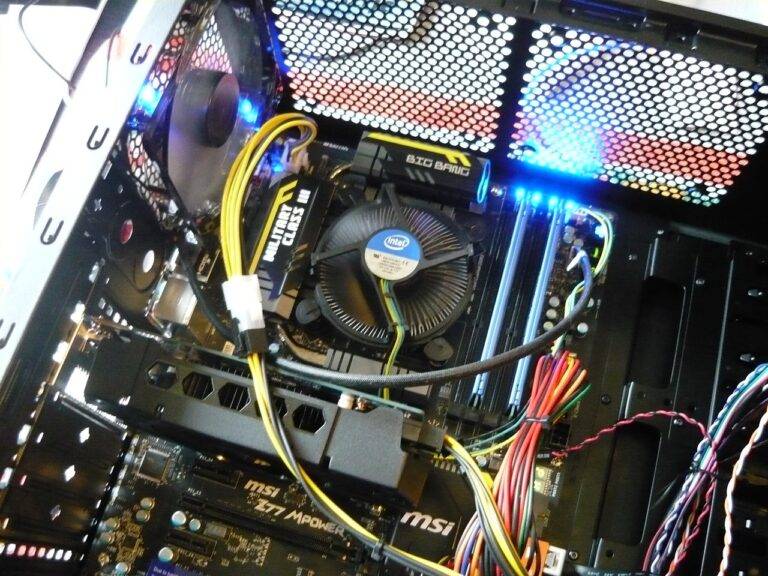

In today’s fast-paced financial landscape, the impact of technology on trading practices is undeniable. With the rise of electronic trading platforms and advanced algorithms, the way trading is conducted has undergone a significant transformation. Traders now have access to real-time market data, advanced analytical tools, and lightning-fast execution speeds, allowing them to make split-second decisions with precision and efficiency.

One of the key benefits of technological advancements in trading is the increased liquidity and efficiency of markets. Automated systems enable large volumes of trades to be executed swiftly, tightening bid-ask spreads and reducing transaction costs. This has opened up new opportunities for traders to capitalize on price discrepancies and engage in high-frequency trading strategies. Additionally, the use of algorithms has helped mitigate human error and emotional biases, leading to more disciplined and systematic trading practices.

• The increased liquidity and efficiency of markets have allowed for tighter bid-ask spreads

• Automated systems enable large volumes of trades to be executed swiftly, reducing transaction costs

• Technology has opened up new opportunities for traders to capitalize on price discrepancies

• Algorithms help mitigate human error and emotional biases in trading practices

The Rise of Algorithmic Trading

Algorithmic trading has significantly transformed the landscape of financial markets in recent years. By leveraging complex algorithms and computer programs, traders can execute high-frequency trades with incredible speed and efficiency. This automated approach to trading allows for rapid decision-making and the ability to capitalize on market opportunities instantaneously.

One of the primary advantages of algorithmic trading is its ability to remove emotional biases from the trading process. Unlike human traders, algorithms operate based on predetermined parameters and rules, which helps to eliminate impulsive decision-making and emotional reactions to market fluctuations. This rational and systematic approach can lead to more consistent trading outcomes and improved risk management strategies.

What is algorithmic trading?

Algorithmic trading refers to the use of computer algorithms to automatically trade securities in financial markets.

How has technology impacted trading practices?

Technology has revolutionized trading practices by enabling faster and more efficient transactions, as well as the development of complex algorithms for trading strategies.

Why has algorithmic trading become more popular in recent years?

Algorithmic trading has become more popular due to advancements in technology, increased market competition, and the ability to quickly execute large volumes of trades.

What are the benefits of algorithmic trading?

Some benefits of algorithmic trading include increased speed of execution, reduced transaction costs, improved liquidity, and the ability to backtest trading strategies.

Are there any risks associated with algorithmic trading?

Yes, there are risks associated with algorithmic trading, such as system failures, market volatility, and the potential for unintended consequences from complex algorithms.

How can individual traders participate in algorithmic trading?

Individual traders can participate in algorithmic trading by using automated trading platforms or partnering with firms that offer algorithmic trading services.